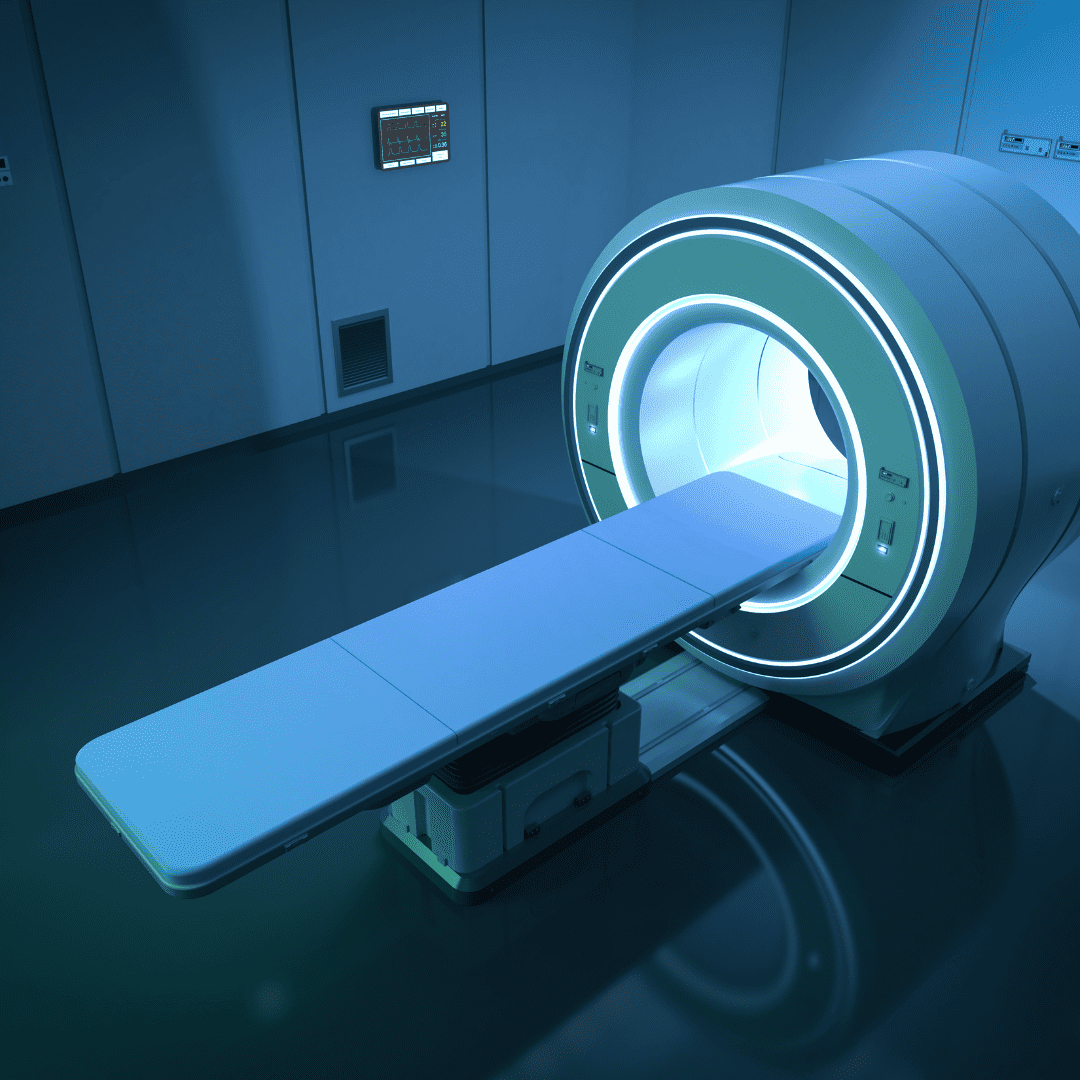

Transform Patient Care in 2024

by Financing Medical Equipment

The evolution of medical technology is transforming the healthcare industry, and providers who have access to the latest medical equipment are leading the charge toward